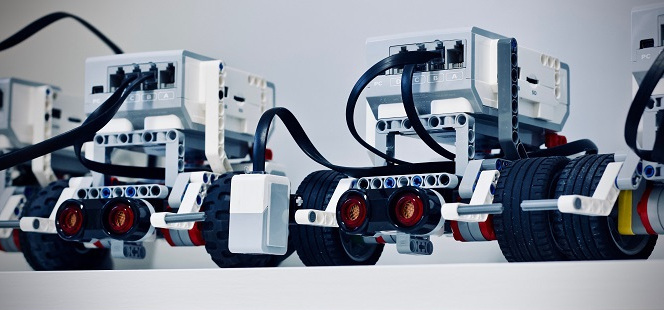

At China e-commerce giant JD.com’s automated warehouse in Shanghai, opened in June 2018, 20 industrial robots with autonomous and intelligent action can pick, move, and pack packages, while other robots convey packages to loading docks and trucks. The factory also equips with camera systems and robot controllers. The highly-automated sorting technology sorts up to 16,000 packages per hour with 99.99% accuracy. The automated warehouse cuts human workers from 400 to just four to monitor the robots. Over 90% of its first-party orders are delivered either within the same day or the next day across China. It aims to provide one-hour delivery in chosen cities. JD.com has also extended automation to its logistics process through a network of autonomous drones based in Shaanxi province.

According to the Top 100 Retailers in Asia-Pacific report by Euromonitor International, Amazon is China’s third-largest online retailer after Alibaba and JD.com in 2018. Bases in the US, Amazon has empowered robotic system years aback. Amazon’s latest robotic technology is the employment of robots that can interact collaboratively with sales associates to do different mobility tasks. Its newest type of robot can sort and route individual packages, at the same time calculate the most efficient path on the facility floor, maximize throughput, improve quality control and maximize sort density. There are 200,000 first- and third-party robots working alongside with 300,000 people at Amazon’s hundreds of sorting and distribution facilities.

The International Federation of Robotics (IFR) in Shanghai projected in its latest industry report the worldwide sales of logistics robots to reach US$22.5 billion in 2022, with total shipments of 712,000 units. These figures are generated from an estimated US$5.7 billion in sales and 176,000 units shipped for 2019. Logistics market is the rising star driver of the global robotics industry.